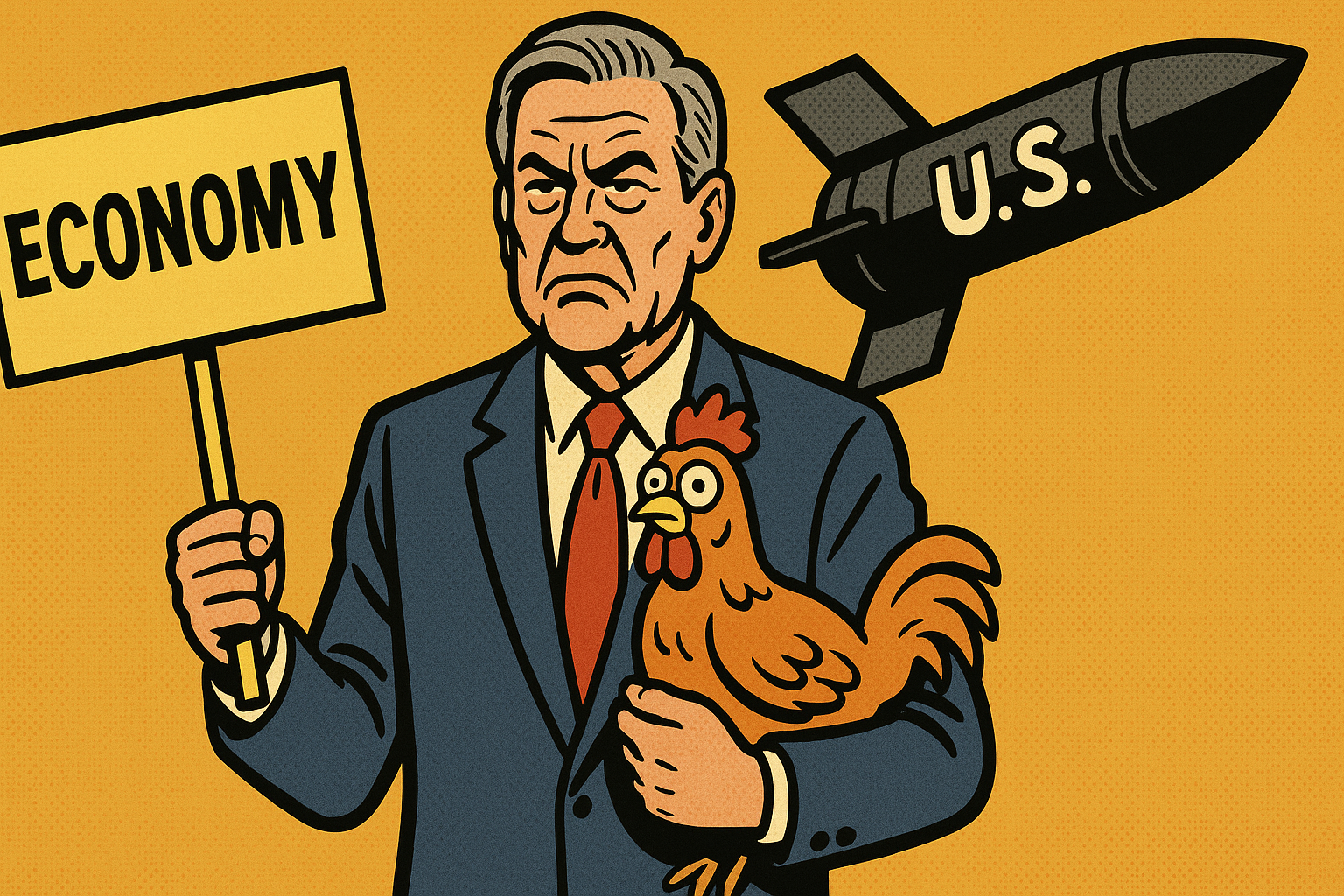

Washington, D.C. – Global markets entered a period of heightened volatility Tuesday after U.S. lawmakers escalated their ongoing standoff over the nation’s debt ceiling, repeatedly assuring anxious investors that “absolutely nobody will blink” and “economic armageddon is probably not that bad anyway.” Major indices seesawed throughout the day while world leaders watched what analysts are calling “the most televised game of chicken in financial history.”

Congressional leaders from both parties convened for a rare joint press conference on Capitol Hill, standing shoulder to shoulder as they reaffirmed their plans to hold their ground. “Financial ruin is, frankly, a matter of perspective,” said Senate Minority Leader Driftwood Baines (R-NV), citing a recent staff survey indicating that 63 percent of the House Budget Committee “kind of want to see what happens if we just let go for once.” Sources close to negotiations report bipartisan agreement that the stakes “cannot possibly be as severe as economists keep saying, probably.”

International response has been swift but measured. The European Central Bank’s president, Dr. Linna Jensen, called a special meeting to discuss “the ongoing American performance art piece,” while the Shanghai Composite’s statement noted that “markets have endured Black Monday, Black Tuesday, and one slightly gray Thursday—what’s a little more color?” Nevertheless, several global exchanges introduced new “panic pause” mechanisms, allowing traders to stop trading in order to meditate, cry, or “just wander off for a bit.”

Attempts at fiscal compromise were set back by a Congressional Budget Office (CBO) report predicting “severe, indefinite consequences up to and including the spontaneous ignition of loose paper currency.” However, Treasury Secretary Velma Yarrow, in a letter to Congress, wrote that such outcomes are “statistically rare and honestly kind of thrilling.” An annex to her letter, prepared by the Department of Financial Outlook, suggested that the international monetary order might simply “self-correct” or, failing that, “redistribute itself across a parallel timeline.”

Meanwhile, private sector leaders scrambled to adjust to rapidly shifting expectations. Morgan Stanley launched a “Post-Republic Era” ETF, while Delta Airlines announced it would begin accepting seashells as payment on all domestic flights as a proactive measure. Insurance companies reported a sharp uptick in requests for “existential disaster” coverage, now available as an add-on for select policyholders.

By late afternoon, market consultants warned of mounting “uncertainty fatigue” among algorithmic trading bots, with several top-performing AI programs reportedly placing all their portfolio assets into lottery tickets, beanie babies, and canned peaches. “We’re working under the assumption that the rules of macroeconomics may simply change by congressional vote,” admitted Dr. Sonia Grapeseed, senior volatility strategist at the Institute for Predictable Futures.

As of press time, Capitol Hill sources indicated both sides had acceded to an emergency recess, citing the traditional legislative panic response of “sleeping on it.” Economists, investors, and world leaders alike are now preparing for what is commonly referred to as The Great Blink, should it occur, or, in the event that it does not, “whatever comes after.”

Leave a Reply to griftspace Cancel reply